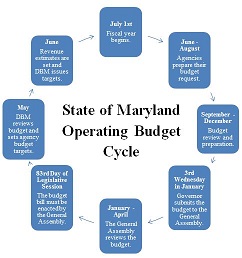

Citizen's Guide to the Budget: Maryland's Operating Budget Cycle

Main_Content

Click the image below to view details:

Click the image below to view details:

May

- Department of Budget and Management (DBM) reviews resources and budgetary needs to be considered in establishing agency budget targets for the following fiscal year.

June

- Preliminary expenditure estimates are made. DBM prepares and issues to

state agencies budget request targets and budget instructions for the next

fiscal year.

July 1

- Current fiscal year begins.

June - August

- Agencies make internal budget allocation decisions and prepare agency budget request.

Late August – Late September

- Agency budget requests are submitted to DBM.

September - December

- DBM reviews agency budget requests and makes recommendations to the Governor.

- Board of Revenue Estimates approves final revenue estimates upon which the proposed budget will be based.

- Governor makes his decisions on the budget allowances for the next fiscal year.

Third Wednesday in January

- Governor submits a "balanced" operating budget to the General Assembly, consisting of the budget bill and its detailed supporting documentation.

- In the case of a newly elected Governor, the balanced budget proposal is due to the General Assembly no later than ten days after the second Wednesday in January, which is the start of the Legislative Session.

January -April

- The General Assembly reviews, holds hearings, and makes decisions on the budget.

83rd Day of Legislative Session

- The Maryland Constitution requires the General Assembly to enact a balanced budget by the 83rd day of the legislative session, or one week before the session ends.

- If it fails to do so, the Governor must call for an extended session. If the General Assembly fails to enact the budget by the 90th day of the Session, then it will go into the extended session at which only the budget may be considered.

- The budget bill becomes law immediately upon enactment.

July 1